The 2024 tax season kicks off this month with the South African Revenue Service (SARS) opening the auto-assessments portal for an expanded pool of taxpayers, which will run from today the 1st of July until the 14th of July.

This as SARS moves to earmark the 15th of July as the start of the Filing Season for provisional and non-provisional taxpayers who are required to file a tax return with the process expected to close in October.

Taxpayers whose contact details, including an email address and cell phone number, as well as banking details, have changed, have been encouraged to update these details on eFiling or the SARS MobiApp to facilitate an easy and seamless Filing Season.

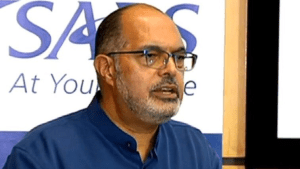

“The non provisional taxpayers will be receiving the auto assessment from today up until the 14th of July and the auto assessment is automatically generated by SARS based on a third-party providers be it medical aid, be the insurance company, etc, that information is used to compile an assessment which is then is then added up and reconciled. And to the taxpayer in the form of an SMS if the taxpayer is happy with everything the taxpayer does not have to do anything. The refund if it’s due, it will be received within the 72 hours. However, if the taxpayer is not pleased the taxpayer is free to make an amendment, they can go to the SARS website and file their return with those amendments. Taxpayers are free to make changes that they deem were not captured,” Siphithi Sibeko, SARS Spokesperson.

Video: 2024 Tax Season – SARS opens auto-assessments portal until 14th July